Just a name and account number aren’t enough for cross-border payments. You also need the right SWIFT and IBAN codes so banks can route your money to the correct place, fast and safely.

What is a SWIFT code?

A SWIFT (BIC) code is the bank’s global address. It tells the network which bank should receive the funds.

- Length: 8–11 characters

- Structure: Bank (4) + Country (2) + Location (2) + Branch (3, optional)

What is an IBAN?

An IBAN is the standardized number for the specific account within that bank.

- Length: up to 34 characters

- Structure: Country (2) + Check digits (2) + BBAN (bank + account details)

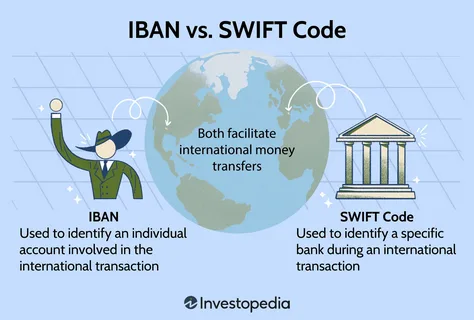

SWIFT vs IBAN (simple view)

- Function: SWIFT identifies the bank; IBAN identifies the exact account.

- Format: SWIFT = 8–11 characters; IBAN = up to 34 characters.

- Where used: SWIFT is global; IBAN is common in Europe, the Gulf, and parts of Asia/Africa (not used in the U.S./Canada).

Why accuracy matters

Getting these codes wrong can cause returns, delays, or funds held for checks—plus extra fees to trace or reverse. Always double-check both fields before you send.

How to find them

- Bank statements: Often list IBAN (and sometimes SWIFT).

- Online banking/app: Look under account details or international transfers.

- Official support: Call your bank if unsure—avoid third-party lookups.

- Sanity checks: Confirm format/length and verify with the recipient.

How Botim makes it easier

International transfers can feel complex, but Botim streamlines the process by:

- Auto-filling or validating required bank codes based on country/bank

- Flagging errors before you submit to prevent failed transfers

- Providing a simple, fully digital flow with live status updates

Bottom line

Use SWIFT to select the right bank and IBAN to confirm the right account. Double-check both to avoid stress, delays, and extra costs—and let Botim handle the heavy lifting behind the scenes so your money arrives smoothly.